Spotlights

Agricultural Lending Manager, Farm Credit Analyst, Agricultural Finance Officer, Rural Credit Portfolio Manager, Agricultural Loan Underwriter, Agribusiness Credit Specialist, Farm Loan Administrator, Agricultural Risk Assessment Manager, Agri-Finance Relationship Manager, Crop and Livestock Loan Officer

Agriculture is big business. Huge, in fact, with ~$1.26 trillion contributed to America’s gross domestic product in 2021! The sector is so large there that many financial lenders specialize in only agricultural lending. Such organizations employ Agricultural Credit Managers to oversee ag loans and other types of ag financing.

Part of an Agricultural Credit Manager’s job is to assess loan applications, which involves determining the financial health and creditworthiness of potential borrowers, as well as suitable loan amounts and interest rates. These managers work with borrowers to explain loan terms and offer advice aimed at reducing risks and achieving positive outcomes for all parties. In addition, Agricultural Credit Managers often help develop relevant ag-related credit policies based on laws, regulations, and industry trends.

- Empowering agricultural business owners with the funding they need to grow

- Being part of a massive sector that is vital to the economy and the food supply chain

- Working in a lucrative, specialized niche with great career opportunities

- Impacting the financial health and stability of rural communities

Working Schedule

- Agricultural Credit Managers work full-time jobs, typically during normal bank hours, with nights, weekends, and holidays off. Occasional travel may be necessary.

Typical Duties

- Schedule appointments to meet with loan or credit applicants and other potential borrowers, including farmers, local agribusinesses, or rural community businesses in the ag sector

- Review applications and verify reported income, assets, property values, tax payments, and debts of potential borrowers as part of the underwriting process

- Complete financial spreading tasks to transfer applicant financial data into analysis software

- Consider specific risks outside of the borrower’s control, such as market conditions, crop yields, livestock prices, etc.

- Collaborate with analysts and property appraisers, as needed

- Determine whether or not applications should be approved, what collateral needs to be put up (if any), the loan or credit amounts to be offered, suitable interest rates, and applicable repayment terms

- Complete applications and carefully review risks and terms with borrowers

- Keep clients updated on any information relevant to their accounts/portfolios

- Meet with institutional leadership to discuss issues, priorities, and goals

Additional Responsibilities

- Conduct periodic, scheduled reviews of existing accounts

- Complete training and development sessions, or organize them for other team members, as needed

- Help write, review, or revise credit administration policies to align with updated laws, regulations, and guidelines, in order to improve efficiency and compliance

- Maintain good relations with local farmers, agribusiness owners, industry associations, and related organizations or agencies

Soft Skills

- Analytical

- Communication skills

- Customer service

- Decisive

- Detail-oriented

- Independent

- Integrity

- Objective

- Organized

- Patient

- Problem-solving

Technical Skills

- Financial modeling and analysis skills

- Credit evaluation and loan management software

- Knowledge of the agricultural sector

- Agricultural markets

- Crop production

- Farming economics

- Livestock prices

- Risk assessment and management principles

- Spreadsheets

- Customer relationship management software

- Banks, credit unions, and other lending institutions

Agricultural businesses are vital to the economy at all levels but have particular impacts on rural communities. When an ag business fails for any reason, the loss can be devastating to the local economy. But private lending institutions can’t afford to take big risks when it comes to offering loans or extending credit.

Agricultural Credit Managers must be very objective when assessing the creditworthiness of a business. They can’t rely on wishful thinking. They must also consider the effects of external factors that may help or hurt the borrower’s business. Sometimes credit managers have to make tough and even unpopular choices, without seeming to come across as unfair or unempathetic.

The agricultural sector has been hit hard by various climate and environmental factors, which can increase costs, decrease crop production, and lead to financial losses. Agribusinesses must do their best to adapt, which can involve making “climate-smart” practices or trying more resilient crop varieties. In addition, many farmers are shifting to more sustainable and environmentally-friendly practices, though there can be added costs to such moves.

The FDIC lists five “perennial health hazards” to the sector, including environmental risks, market volatility, rising interest rates, geopolitical risks, and a general decline in farmland values. It goes on to note that “Robust credit concentration risk management begins at the bank level, includes sound agricultural lending practices, and considers any associated third-party risks.” In other words, Agricultural Credit Managers have to understand and follow established practices to help mitigate the above risks as best as possible.

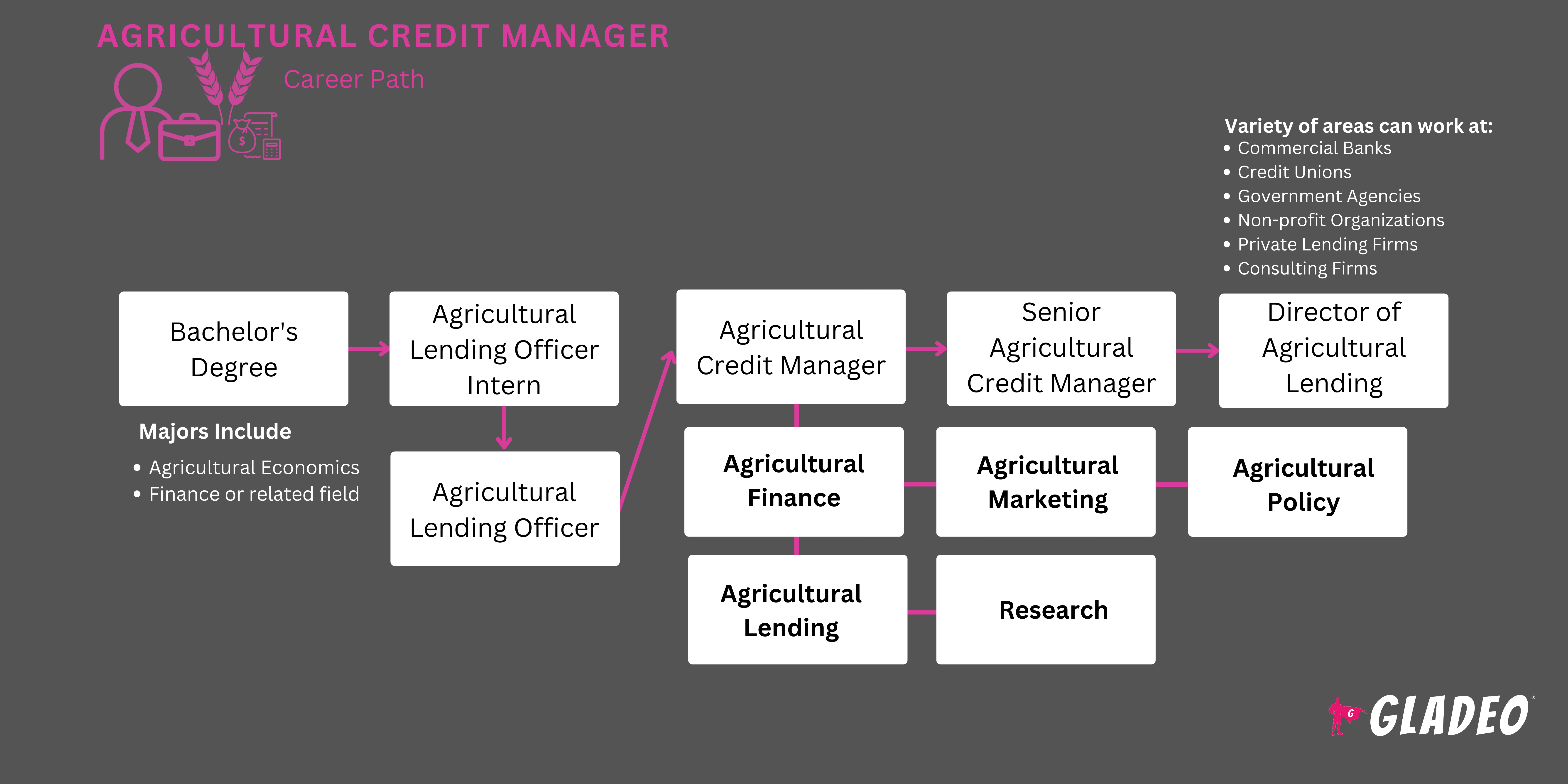

- Agricultural Credit Managers often have a bachelor’s or master’s degree in finance, accounting, or business

- Most applicants won’t start in a managerial role. Employers usually want candidates with relevant experience in agriculture-related credit management or collections

- Some employers hire from within, promoting current employees into management positions

- Students should also have a strong understanding of the agriculture sector and the variables which impact its financials. This can be gained through college classes, such as a minor in agricultural business

- Businesses typically provide some On-the-Job training for new credit managers and may send them to courses to hone their skills

- Completing a Certified Management Accountant or Certified Public Accountant credential can enhance one’s qualifications and professional credibility

- Students should seek colleges offering majors in accounting, finance, or business

- Consider schools that also feature courses in agricultural business

- Look for programs that have internships or other opportunities where you can gain practical experience, especially related to agriculture credit management

- Always compare the costs of tuition and other fees. Review your options for scholarships and financial aid

- See if the program has any partnerships with companies that hire grads!

- Take note of graduation and job placement statistics for alumni

- High school students should take courses in business, accounting, finance, math, English, communications, information technology, statistics, and speech or debate

- Knowledge of agriculture and agricultural business practices will be very useful

- Having banking and credit management experience can be helpful. Look for part-time jobs where you can rack up some relevant work experience

- Apply for relevant internships, through your school or on your own

- Read magazines and website articles related to agribusiness and specialized lending

- Consider doing ad hoc courses via Coursera or other sites to learn more about agribusiness

- Request an informational interview with a working Agricultural Credit Manager at a local bank or other lending institution

- Students may also want to brush up on government laws and loan options related to farmers and agribusiness owners, such as Farm Ownership Loans, Farm Operating Loans, Marketing Assistance Loans, the Inflation Reduction Act Assistance for Distressed Borrowers, etc.

- Check out job portals like Indeed.com, LinkedIn, Glassdoor, Monster, CareerBuilder, SimplyHired, or ZipRecruiter

- Don’t expect to start at a managerial level! Unless you already have a few years of relevant work experience, you’ll need to apply to entry-level positions first

- Consider relocating close to a rural area where there are farm banks and agribusinesses

- Note, the FDIC states there are 1,500 farm banks, “heavily concentrated in the nation's heartland, including the Corn Belt and Great Plains”

- Stay in touch with classmates and use your network to get job tips. Most jobs are still found through personal connections, and the world of agricultural lending isn’t that big!

- Ask your instructors, former supervisors, and/or coworkers if they’re willing to serve as personal references. Don’t give out their personal contact information without prior permission

- Check out some Agricultural Credit Manager resume examples and sample interview questions

- Practice doing mock interviews with your school’s career center (if they have one)

- Dress appropriately for interviews and show your enthusiasm for and knowledge of the field

- Work objectively while ensuring clients feel taken care of. Explain negative loan or credit decisions in a way that is empathic and does not burn bridges

- Resolve client issues quickly and try to ensure the best outcomes for everyone. Lenders rely on repeat business from clients, and it’s more cost-effective to keep existing clients than to find new ones

- Keep track of trends and challenges within the agribusiness industry (in particular, all factors that affect production and profits)

- Be proficient in software programs for financial modeling, risk assessment, credit evaluation and loan management, and customer relationship management

- Collaborate effectively with team members and develop strong relationships with local farmers, agribusiness owners, and other stakeholders in the community

- Communicate regularly with leadership and stakeholders to ensure objectives and problems are clearly defined

- Let your supervisor know you’re interested in career progression and ask for their advice

- Earning a graduate degree may help some Agricultural Credit Managers qualify for advancement

- For those working at small institutions, you may have to apply to work for a larger organization to make a bigger paycheck or reach larger career goals

- Completing a Certified Management Accountant or Certified Public Accountant credential should enhance your qualifications. Advanced certifications such as the Credit Executive Leadership Institute’s Certified Credit Executive can boost your credentials even more!

Websites

- AgFirst Farm Credit Bank

- AgriBank, FCB

- AgVantis Inc.

- American Bankers Association

- American Institute of Certified Public Accountants

- Association for Financial Professionals

- CFA Institute

- CoBank, ACB

- Farm Credit

- Farm Credit Administration

- Farm Credit Bank of Texas

- Farm Credit Financial Partners Inc.

- Farm Credit Foundations

- Farm Credit System Insurance Corporation

- SunStream Business Services

Books

- Eating Tomorrow: Agribusiness, Family Farmers, and the Battle for the Future of Food, by Timothy A. Wise

- Fundamentals of Agribusiness Finance, by Ralph Battles and Robert Thompson

- Principles of Agricultural Economics, by Andrew Barkley and Paul Barkley

Compared to some career fields, Agricultural Credit Management isn’t a huge field and most jobs will require living near rural areas—which may not be everyone’s cup of tea! If you’re curious about related career options, consider the below similar occupations:

- Accountant and Auditor

- Budget Analyst

- Financial Analyst

- Insurance Sales Agent

- Insurance Underwriter

- Loan Officer

- Personal Financial Advisor

Newsfeed

Featured Jobs

Online Courses and Tools